Whether your business needs a quick and easy term loan or help accepting payments from customers, altbanq has the answer for you.

Existing customer? Sign in

With you as our focus, our financial solutions are crafted to empower your business, not hindered by red tape and rigid structures. Whether it’s accessing capital through Tailored Term Loans or ensuring seamless operations with our Payment Processing, We’re here to support your journey towards efficiency and effectiveness with the financial alternative that gets your business moving.

We support you every step of the way

Experience efficient, adaptive term loans for your business journey.

Enhance business performance with our credit card processing solutions.

Secure a Zero-Interest Loan

Switch to altbanq Payments to secure a zero-interest loan.

Stay up-to-date with the latest business news, insights, and strategies with the altbanq blog.

Personalized Guidance for Your Business Journey

Don’t navigate the complexities of small business loans alone. Let our experienced U.S. based loan advisors simplify the process and guide you every step of the way.

(212) 235-5455

Monday – Friday

9:30 a.m. – 6:00 p.m. EST

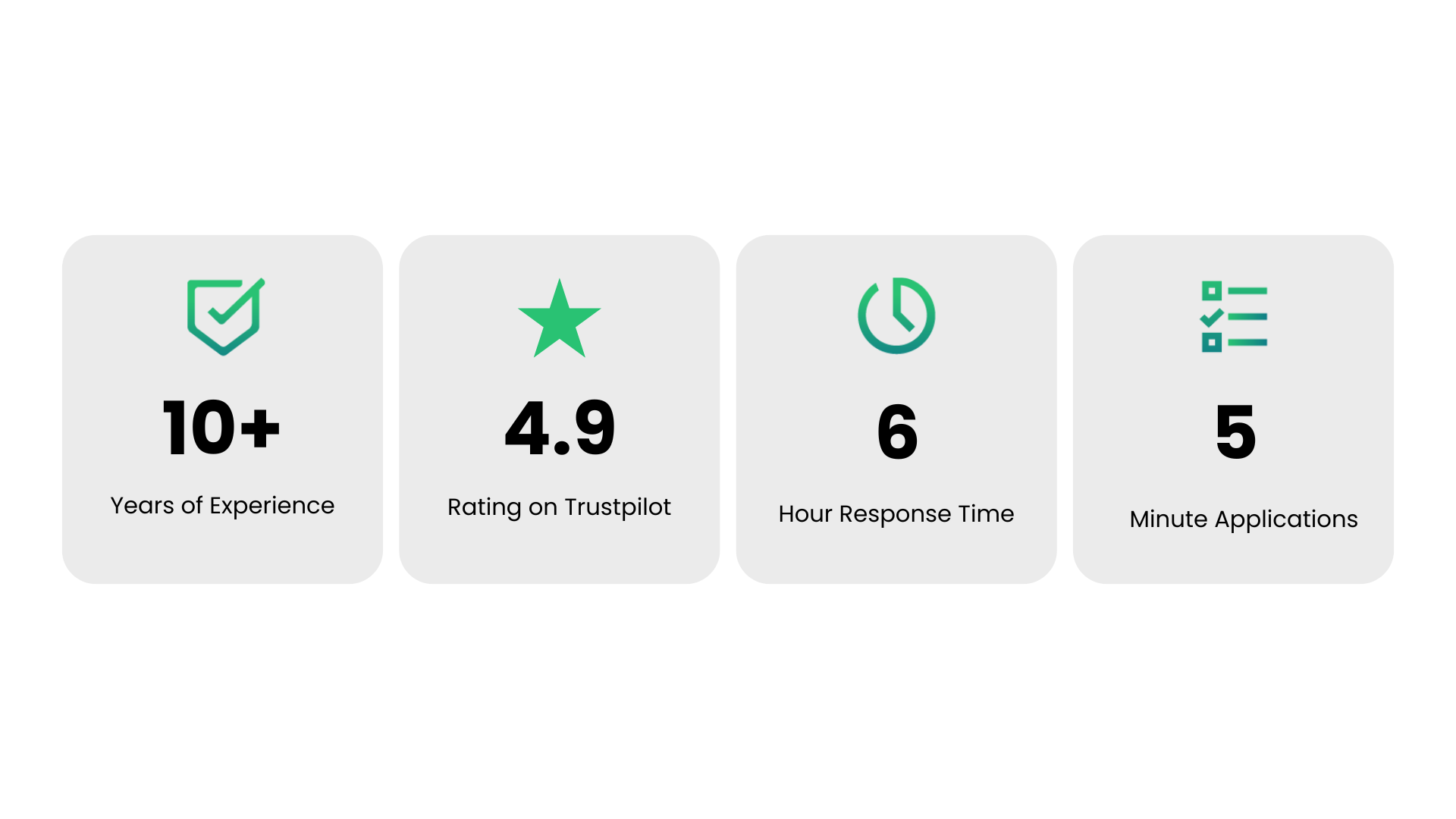

altbanq is an alternative finance provider that was launched to fund businesses faster and more reliably than traditional financing sources. altbanq is comprised of industry veterans with the shared goal of providing small business owners with the resources needed to build a solid financial foundation to grow their business.

For altbanq lending, our application process takes less than 5 minutes, with successful applicants receiving funds within 24 hours.

For altbanq payments, our application procedure is even quicker, with businesses enjoying secure payment services as soon as they agree to our offer.

We require applicants to hold a minimum of 51% company ownership and provide us with the necessary documentation.

For altbanq Lending, 3 most recent months of business bank statements.*

For altbanq payments, either 1 month of merchant credit card statement or your most recent bank statement.*

* Please note that in cases where qualification cannot be determined, additional documentation may be required.

Our underwriting team will provide maximum approvals using our proprietary scoring model. Qualifications are determined using many factors, including business cash flow, length of time in business, industry, and your business & personal credit scores.